Why and When do Fibonacci Levels Work? (Part 4)

Fibonacci levels consist of Fibonacci retracements and Fibonacci targets, as recently discussed in 2 previous posts of our a series on Fibs. The beauty of combining both entries and exits in 1 tool is sheer genius and a very powerful tool. One of difficulties in real live trading is that the tool will not always work well… so why and when do Fibonacci levels provide value for you as a Forex trader?

Why do Fibonacci Levels Work?

Fibonacci levels go hand in hand with the market psychology. There are times when the market will pullback to correct an uptrend or downtrend before continuing. Or there are moments when traders anticipate a momentum continuation for a ‘zigzag’ (fast 3 legged movement). In those cases Fibonacci retracements provide discounts for entries and Fibonacci targets offer profitable exits. It is the trader’s and hence market psychology that goes hand in hand with these Fibonacci levels.

Fibonacci is also a mathematical concept. The 61.8 ratio is called the Golden Phi, which is also called the Golden Ratio. From that perspective the 61.8% Fibonacci retracement level is extra special. Kelper called it “one of the jewels of geometry“, Pacioli named it the “divine proportion“, and finally Greeks used for it the letter “phi“.

The Phi is a crucial element in Forex Trading. Two quantities are in the golden ratio if: the ratio of the sum of the quantities to the larger quantity is equal to the ratio of the larger quantity to the smaller one.

In math this means ((A+B)/A) = PHI. The PHI is equal to 0.618. That is why the 61.8 or 61.8% Fib retracement level is so important in Forex trading. Golden Phi is just a tad more important than the other numbers in Forex trading.

Presence of a Trend or Momentum

Fibonacci stems from math, is called a golden a ratio and goes hand in hand with the market psychology but this does not mean that Fibonacci will work in all circumstances… The ‘trick’ is to know when to use the tool. The Fib tool will not always be of help no matter what the conditions.

There are certain moments when and how Forex traders must use the trading tool to their advantage otherwise it will not help (the ‘how’ part will be released in July). In fact, it might back fire and cause more mess than help.

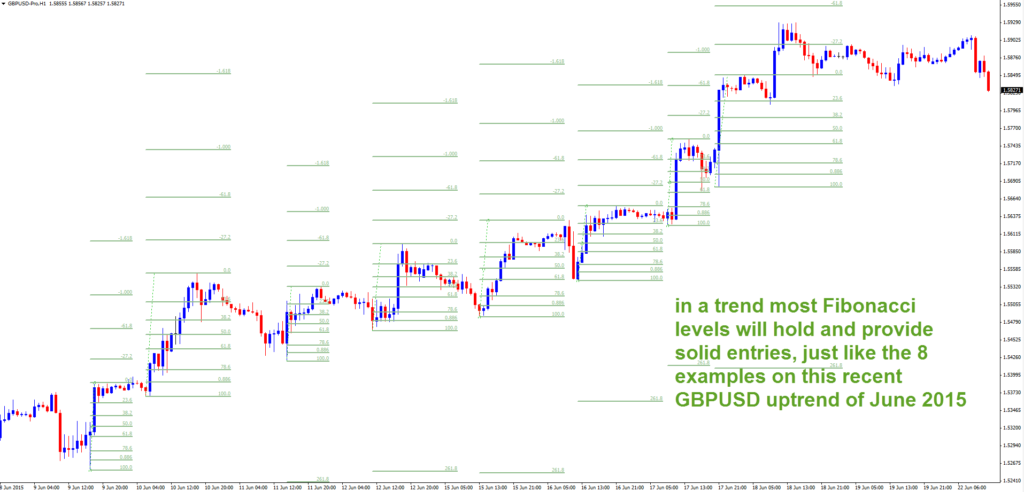

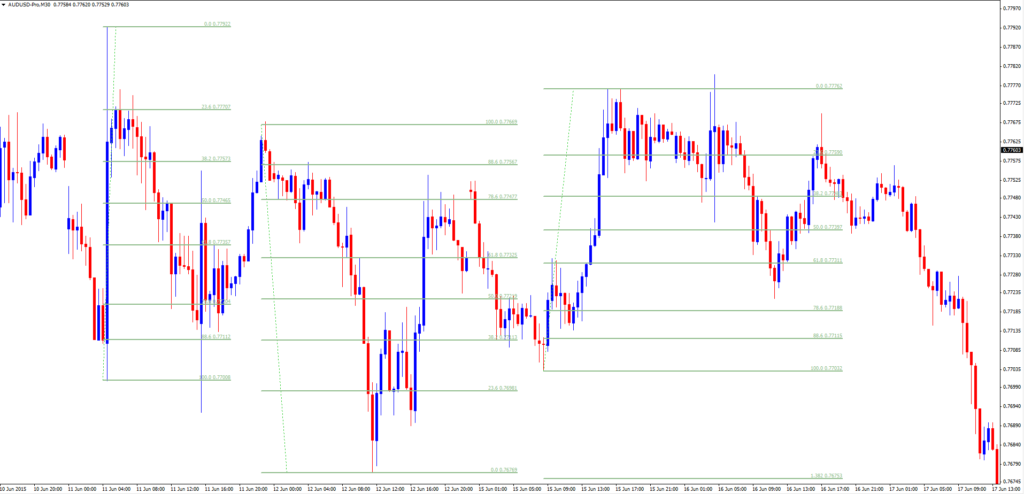

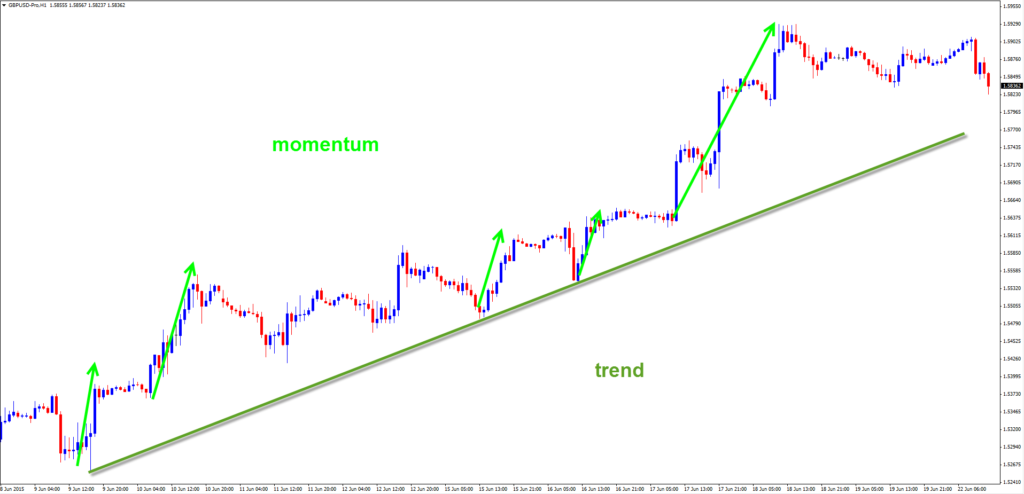

Fibonacci levels work best in trending markets OR movements with speedy price action. They do NOT work well in consolidations, corrections, ranges and sideways moves, because the Fib levels are mostly ignored and price is more responsive to different levels such as tops and bottoms.

(Fibs work poorly in choppy market)

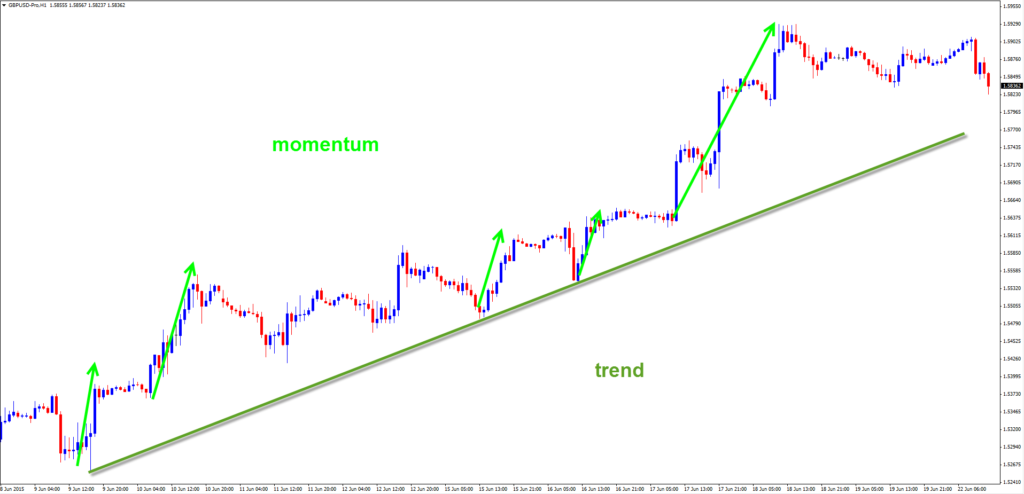

If the currency pair, however, is indeed trending OR it is showing momentum THEN the tool is a great asset! In those cases the Fib levels provide a precise indication where there is a high chance that the market could turn back in the direction of the trend. The existence of a trend or momentum is very important element.

Defining the trend and momentum is again a separate topic on its right and will deserve full attention on our blog once our series on Fibonacci is completed. Simply put a trend requires a lower high and higher high (in an uptrend) OR a higher low and lower low (in a downtrend). A momentum is the same as a trend but on a smaller scale: instead of looking at tops and bottoms we want to see candles with lower highs in a downtrend and higher lows in a uptrend.

When to Expect Which Levels?

There are quite a considerable number of Fibonacci levels (I use 6). There is a major difference between taking a trade at the 23.6% Fib or the 88.6% Fib. The latter one offers a lot more reward to risk potential but the first could have a higher win percentage. Forex traders can roughly estimate which Fibonacci retracement and target will be most likely used by the market.

A trader must realize that price respects different Fibonacci levels depending on the presence of momentum or how the trend has developed so far (remember that Fibs do not work with a trend or momentum).

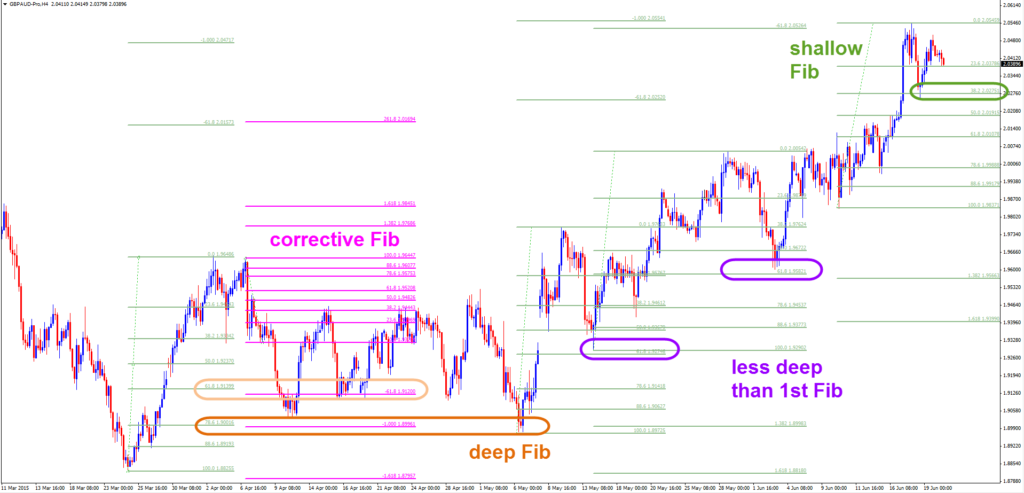

Deep pullback (61.8-88.6%)

Price tends to make a deep pullback when a trend is not yet clearly established. In those cases price can make multiple ups and downs which severely test the bottom (uptrend) or top (downtrend) but without breaking those levels (which would invalidate the trend).

Shallow pullback (23.6-50%)

Once a trend has clearly established itself then a shallow pullback such as the 23.6%, 38.2% and the 50% half way mark are generally levels, which are very typical before the trend continues. Corrections deep to be less impulsive like with deep pullbacks and price tends to correct slow and choppy.

Momentum

Price also can make a pullback when making a clear and sturdy momentum against the trend. In those cases a 3 legged zigzag could allow price to correct deep or shallow (both are possible). Price retraces quick, goes with the trend slow, and retraces quick after which the trend then fully resumes. As traders you must recognize this situation when you trade with the trend, get stopped out and then see price start to go your way. In this case a zigzag could bring price back to a deep pullback and there is confluence between the Fibonacci retracement and the Fibonacci target.

Before leaving, make sure to read our entire Fibonacci series.

Happy Hunting!

Receive our FREE eBook on Fibonacci when you send an email to: [email protected].

See the YouYube video of this post: