ECS’s Quad Pip Strategy

Dear Traders,

As I have promised, today you will see the new strategy that is simple and suitable for intraday and scalp trading. Before I developed the CAMMACD I was trading the EMAs on different setting using the famous MTF principle. Being a momentum trader myself I started with simple strategies for major currency pairs that could have generated profits on intraday basis.

The core of this strategy is the effective use of indicators that are combined into a KIS principle (Keep It Simple). The strategy uses a leading, a lagging and dynamic indicator to optimize entries and exits. This strategy trades all major currency pairs on a 5m timeframe and uses the following indicators:

- 176-Period Exponential Moving Average of Close Price (red)

- 144-Period Exponential Moving Average of Close Price (blue)

- 44-Period Exponential Moving Average of Close Price (red)

- 36-Period Exponential Moving Average of Close Price (blue)

- Awesome Oscillator

- MACD 3, 7, 1

Before we delve deeper into this simple strategy let’s take a look at individual indicators the strategy uses.

Exponential Moving Average

Exponential Moving Averages are considered good indicators by default but unfortunately trading simple crossovers is usually a bad idea since it can’t give you reliable entries. As you can see, from the example of a crossover (50, 100 EMA) on the chart below which gave a clear signal to buy, this trade would have been a loss. The point of trading moving averages is that traders need to develop and learn the patience , and not jump into a trade just because of the simple crossover.

In the next example the moving averages (50, 100 EMA) crossover showed a sell signal but price retracted first. Did you notice the breakout and retracement patterns before the price started to move a direction of a crossover? Great! That is the point of moving averages. We want them to be dynamic levels of support and resistance and not crossover entry signals.

According to a general observation, there are a few things to know when adjusting the MA period:

- The smaller the N period numbers, for example 1, 3, 6 the more movements on the chart, hence the more unreliable the signals are

- If you want to eliminate the noise, use bigger moving averages numbers like 50, 100, 200 etc, since they give a complete picture of a trend without any interruptions.

A combination of smaller and bigger moving averages can give a very good outcome in trading. Based on everything mentioned above, the strategy carefully uses the best available settings for multiple MAs. Those are:

- 176-Period Exponential Moving Average of Close Price (red)

- 144-Period Exponential Moving Average of Close Price (blue)

- 44-Period Exponential Moving Average of Close Price (red)

- 36-Period Exponential Moving Average of Close Price (blue)

Other, than the four different EMAs, the Pip Net strategy uses other indicators to spot price momentum and direction of the price. We will cover each of them separately.

Awesome Oscillator

This indicator was developed by the Bill Williams in his Chaos Trading System.

The Awesome Oscillator is used as a technical analysis indicator for generating buying or selling signals. It consists of a zero line and a green/red indicator on the chart. Awesome Oscillator is calculated by default as subtracting the 34-period simple moving average from the 5-period simple moving average.

The signal for a possible entry is a bar above the zero (o) line. Every bar in histogram which is bigger the a previous one is painted as green or every bar in histogram which is smaller than previous one is painted red.

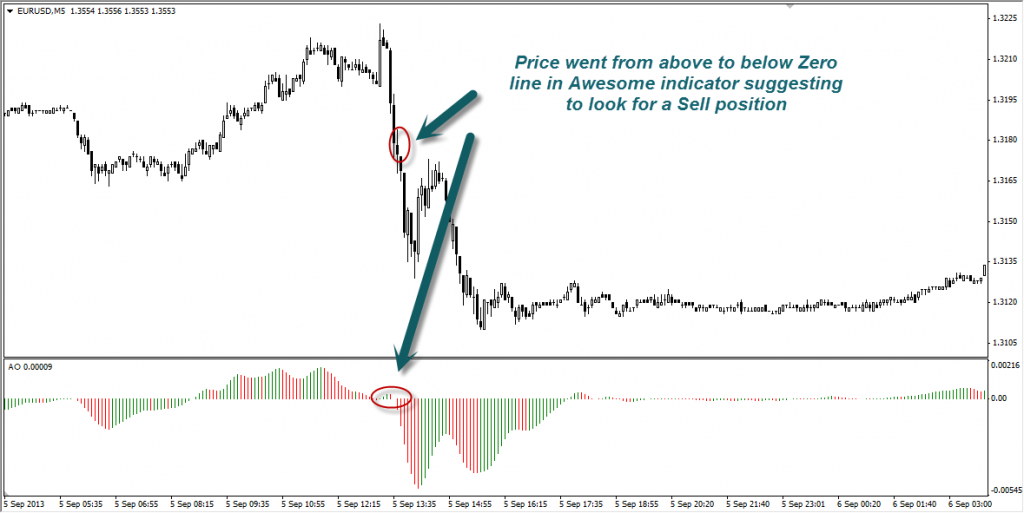

So if a bar is printed above the zero line we should look for a right moment to enter the BUY position, and if the bar is printed below the zero line Trader should look for a SELL position. The immediate break above and below the zero line doesn’t mean that we need to enter the position immediately. This is a very good filter for any system, and should be used as one of the methods of confirmation.

Example for a Buy position shows that the price went from above the zero line, crossed it and started to build a momentum for a Buy position. Exactly the opposite happened in a sell position as the break of the Zero line on histogram give a signal to the trader to look for a potential short.

MACD Indicator

MACD (Moving Average Convergence Divergence) indicator is one of the most commonly used indicators in Forex trading. MACD was developed in the 1970s by Gerald Appel as an oscillator that graphically displays moving averages in relation to price.

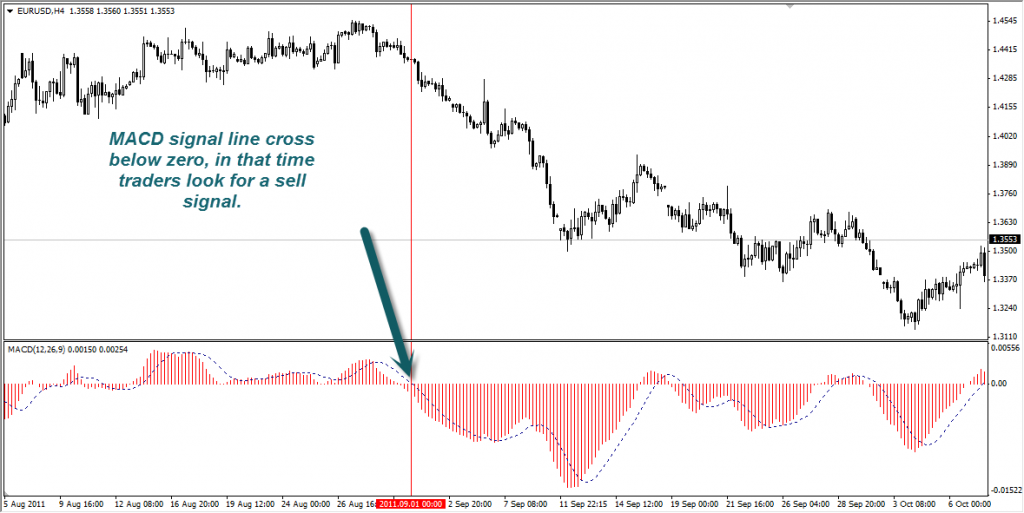

MACD falls into the same family as RSI, CCI and Stochastics, but this indicator can be used to assist traders with finding market momentum, direction, and entries by understanding the MACD line, the signal line, zero line and histogram. Before the MACD can become useful to us as traders, we first need to better understand its components.

The MACD Line is displayed in blue in the indicator below and is built by comparing a 12 period EMA (Estimated Moving Average) to a 26 period EMA.

By comparing moving averages of different durations we can change shifts in trend as it oscillates up and down. Our signal line is comprised of a 9 period EMA of MACD.

How To Trade The Quad Pip Strategy

Based on the individual indicators’ information above the entry position is pretty much straightforward.

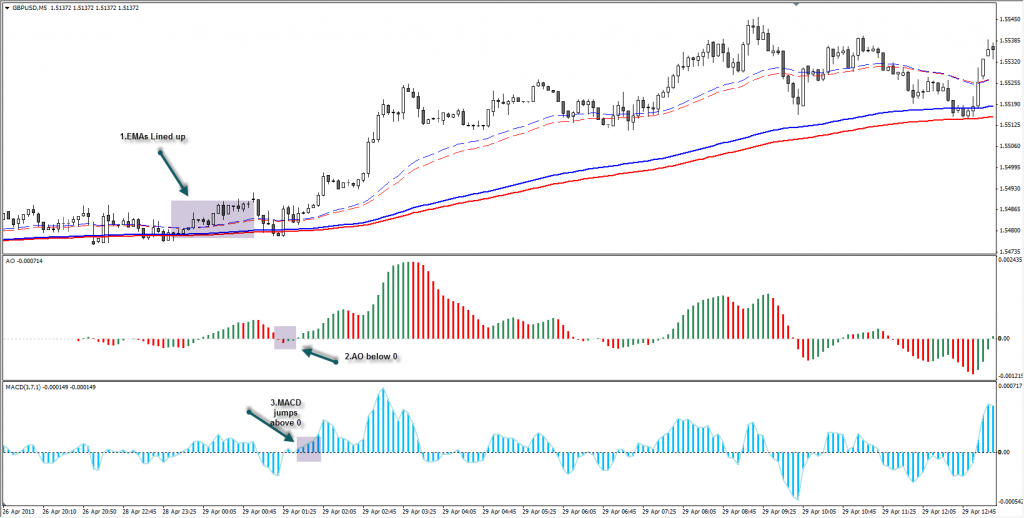

Before we take a buy trade the two above criteria must be met. The 144 EMA must be above the 176 EMA and the 36 EMA must be above the 44 EMA. We then wait for AO to fall below the 0. The final „trigger‟ to the entry is when the MACD closes above the 0 line.

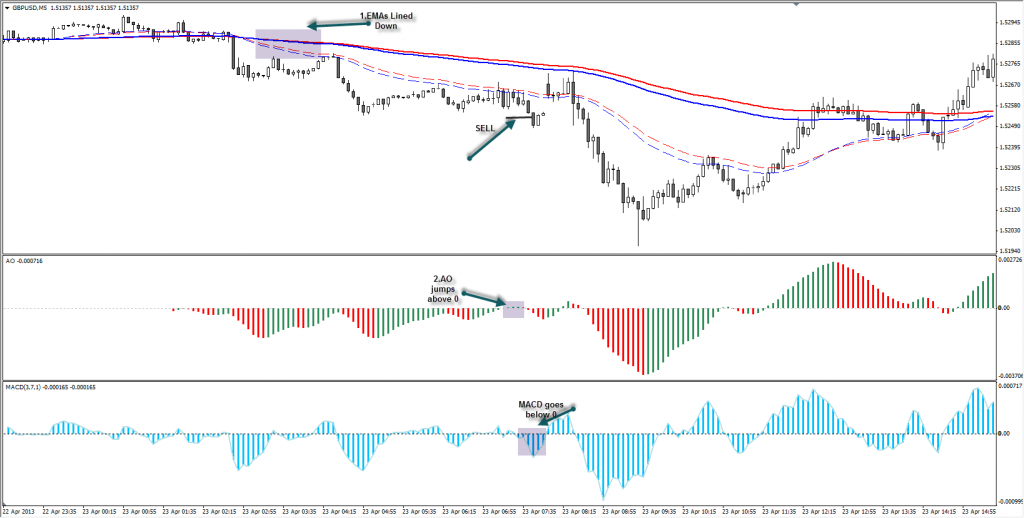

Sell trade is just the opposite of a buy trade. 36 EMA must be below 44 EMA and 144 EMA must be below 176 EMA. We use technical profit targets and stop loss placements. For this purpose the camarilla could be a good option as it is the best pivot point indicator in the market.

Conclusion

Elite CurrenSea has a very unique MACD indicator named ECS MACD. Coupled with our proprietary Camarilla Pro indicator, you can empower every strategy you trade, including this one. This is how you can obtain them as part of CAMMACD system or module.

Cheers and trade safe,

Nenad

Leave a Reply