Full EUR/USD Testing Completed: 60% Wins and 2.57 R:R Ratio

Dear Traders,

Our first round of testing showed promising results with 86% wins and 17% profit. The test period, however, was small because it only included 14 trades.

We indicated that more testing was needed to measure the long-term consistency of the “SWAT-WIZZ” system, which is focused on measuring part our ecs.SWAT system with the Wizz tool. This article explains all the details of our expanded testing which includes 2 years and 8 months of back testing.

This article will also review the performance, drawdown, win percentage, and reward to risk ratio. Last but not least, we will add something called the t-statistic, which calculates whether the system achieved its results by sheer luck or system consistency.

63 Trades with 60% Wins and 2.57 R:R

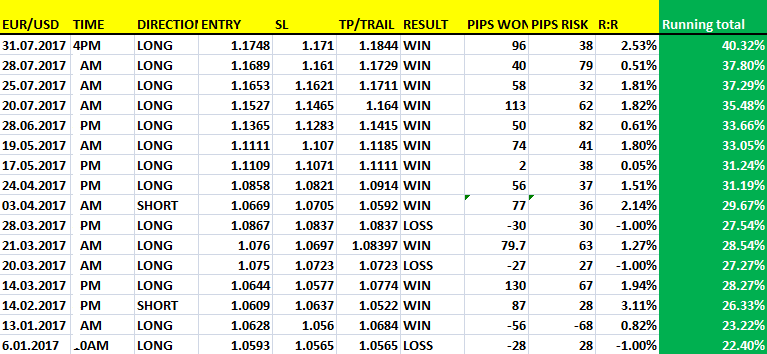

Our EUR/USD 1 hour testing dates back to April 2015 and was completed up to 31st of July 2017. The total test period represents 2 years and 4 months and offers a comprehensive list of all setups and data. (please note that our testing did not include other time frames and currency pairs as yet.)

Here are the results with the EUR/USD 1 hour chart using the SWAT-WIZZ system:

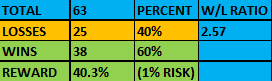

- 63 trades

- Total profit with 1% risk: 40%

- Total profit with 2% risk: 80%

- Win %: 60%

- R:R ratio: 2.57 (the average win is 2.57 larger than the average loss)

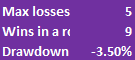

- Maximum losses in a row: 5x

- Max winners in a row: 9x

- Max drawdown: -3.5%

Here is how the results changed when we expanded the time horizon:

- 3 months: initial results showed a 86% win record and 1.57 Reward to Risk (R:R) ratio.

- 28 months: win percentage dropped to 60% BUT R:R ratio increased from 1.57 to 2.57.

Is Track Record Based on Luck?

A positive track record is not really sufficient to show the long-term consistency of a system. Why? The main question is whether you are able to achieve similar results if you repeat the exercise another 10 times?

Believe it or not, positive trading results could just be based on pure luck and have no connection to any long-term skill or approach. You want to apply a trading system that is based true skill and consistency rather than randomly generated lucky results.

The equation used to distinguish the difference between luck and skill is called “T-statistic”.

The border for the distinction between luck and skill is the number 2.0:

- A t-stat below 2 indicates randomness and luck.

- A t-stat above 2 indicates skill and consistent system.

According to Howard B. Bandy, a trading system with a t-stat above 2 or higher is the real deal. This is when you can feel more comfortable about the long-term expectancy and equity curve.

The SWAT setup based on the break of 3rd and 4th Wizz levels (SWAT Wizz) showed a very strong t-stat of 5.09.

What is the conclusion from the t-stat? The system shows long-term robustness and consistency, and not luck.

What is the SWAT-WIZZ System?

The trading statistics are rock solid: the win percentage is decent (60%), the R:R ratio is better (2.57), and the t-stat is even better (5.08).

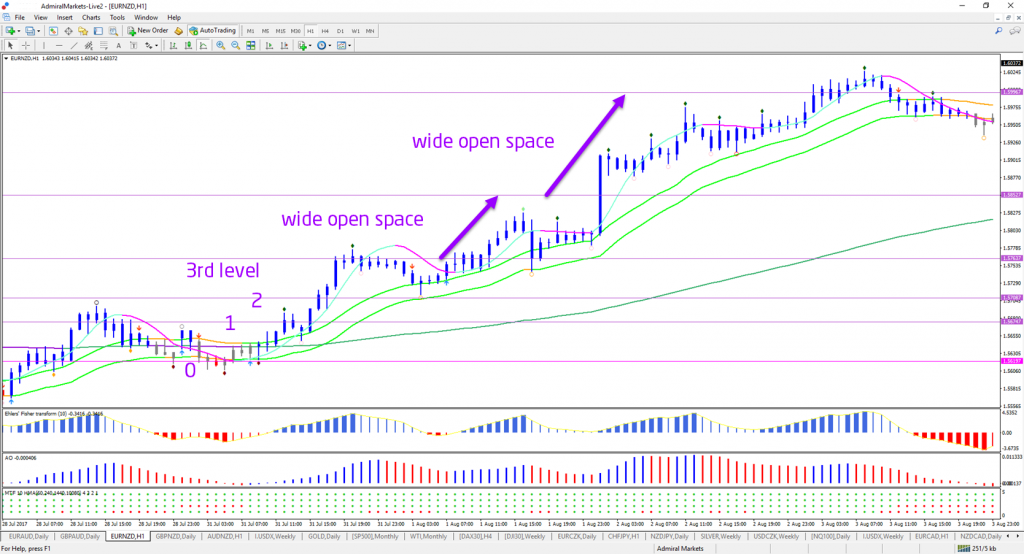

So how does SWAT-WIZZ system work?

The SWAT-WIZZ system is part of the larger ecs.SWAT methodology, which is based on the market structure, patterns, and waves without needing to become an expert technical analyst. Our motto: simple wave trading without knowing the waves!

The second and last step is done by adding the powerful Wizz script, which is an excellent tool for finding the wide open spaces. Wizz is an extremely accurate way of knowing when and where to expect big momentum moves and impulsive price action.

This is a major advantage as price hits the target quickly and offers much better reward to risk ratios. Check out the video below for more info on Wizz.

That’s it! Using both SWAT and WIZZ together is a particularly powerful combination within the larger ecs.SWAT method.

Besides the SWAT-WIZZ system, please note that traders can trade different setups within the larger ecs.SWAT method as well.

Many green pips,

Chris

More info on our ecs.SWAT course and trading system

Twitter: @EliteCurrenSea

YouTube: Elite CurrenSea

Dobrý deň,

aké máte ostatné MA okrem Ema144 v tomto videí?

Pekný deň.

Knut Koine

Dobry den, bohuzel nerozumim Vasi otazku. Pouzivame 21 ema a 144 ema pro nasi charts. Hezky den!