⚖️Cryptocurrency Advantages and Disadvantages – Should You Trade Them?

Dear Traders,

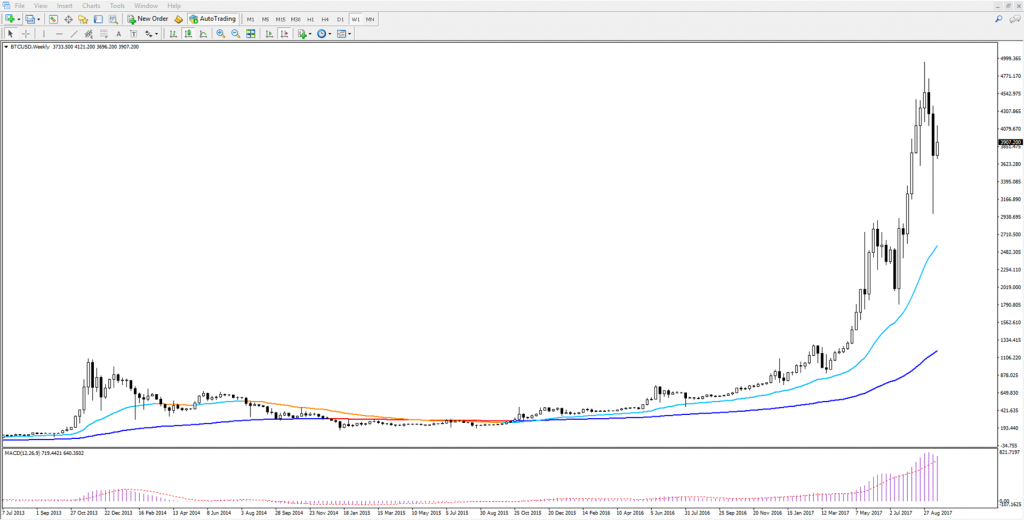

Bitcoin’s rise from below $1000 to nearly $5k has certainly not gone unnoticed in the trading world. Other cryptocurrencies have made similar jumps or even larger ones.

Many Forex, CFD, commodities, and stock indices traders are however still hesitant to trade cryptos (altcoins) despite the massive bullish momentum.

Our article reviews where this hesitation comes from and whether it’s justified. It also examines what the advantages of cryptocurrencies are as well as their disadtantages.

Disadvantages of Bitcoin Trading

The price spike on Bitcoin, Litecoin, Ether and other minor cryptocurrencies is attracting loads of attention – not only from more experienced traders but also from people totally new to financial markets. They read a headline, open a demo account, and see their trade grow 20%, 50% or 100% in value, sometimes literally overnight.

This article wants to first explain the dangers of trading cryptocurrencies before analysing whether it makes sense to trade these financial instruments.

Number 1: Little Historical Support and Resistance Levels

Technical analysis of any chart composes of three major components:

- Trend and momentum: indicates direction and strength of that direction.

- Support and resistance: indicates potential stopping points of that direction.

- Patterns in general, chart and wave patterns: provides information about the market psychology.

Cryptocurrencies have not yet been around for long enough that they offer sufficient information about key support and resistance levels. Even Bitcoin’s years of price action is a short track record when compared to stocks, currencies and commodities that provide key price levels from the last decades.

Number 2: The Danger of Blindly Trend Trading

New traders will be attracted by Bitcoin’s continuous rise. They will believe that trading is simply a matter of buying only and grabbing profits.

Unfortunately, trends do not last forever. When trends do stop, newbie traders are not able to notice the difference… They will keep trading the same way and wonder why their trades are not winning anymore.

We’ve seen this dozens of time. Newbie traders get lucky with a trend and make profits by trading this trend. Then the trend ends and these beginning traders lose all of their profits and more without knowing why.

The main message is: don’t trade blindly. Use the charts as a map to make decisions about analysis, entry and exit. Make sure to avoid any “black swan” event for Bitcoin (image above).

Number 3: Price Volatility

Volatility is good for trading because the price movements up and down offer trading opportunities for traders. Nothing much can be done if price were to go sideways for 1 week, month or year.

Too much volatility, however, is also not ideal for traders because it creates high levels of uncertainty. Find decent entries and exits is (more) difficult if price is moving up and down like roller coaster. It also gives traders less time to react.

Too much volatility, however, is also not ideal for traders because it creates high levels of uncertainty. Find decent entries and exits is (more) difficult if price is moving up and down like roller coaster. It also gives traders less time to react.

Number 4: Market Sentiment is Not Fixed

Sure, the 2017 uptrend on Bitcoin and other cryptos (altcoins) seems like it has no limits and will never stop. But market sentiment can change. And often it does on the most unexpected moments.

Yes, the sentiment is bullish and yes it can stay that way for a while. However, always keep in mind that sentiment has its ups and downs. Nothing is fixed.

Number 5: Uncertainty about Hard Forks and Bitcoin’s Internal Direction

First of all, we are not experts on the internal decisions and directions that the Bitcoin community and developers are discussing. But obviously Bitcoin made a hard fork (split) between two camps, which resulted in Bitcoin and Bitcoin Cash.

From other sources, we have heard that there are more topics within the Bitcoin world that are being debated such as a potential update of the software/protocol to handle 2MB sized blocks. If you know more about this potential 2nd rift, please add a comment below.

Of course, a new split could potentially undermine the confidence of investors and the market in Bitcoin and perhaps also other cryptocurrencies.

Number 6: Conflict with Central Banks and Economic Growth

Bitcoin and other cryptocurrencies are non-centralized and not created by any central bank. If altcoins become very popular as a means for transaction and storing wealth, then this could it more difficult for central banks to conduct monetary policy.

In fact, could it perhaps make central banks obsolete in the long run? This remains to be seen but it could have the following effects:

- Create economic uncertainty and risks as the money supply is shared.

- As cryptocurrencies (till now) have a limited supply, this could enhance deflationary trends or at the very least combat inflation.

- Last but not least, the popularity of cryptocurrencies could also weaken demand for fiat currencies such as the US Dollar, Euro, and Japanese Yen.

Deflation is undesirable for governments with higher levels of debt because the debt become more expensive in real terms. Moderate inflation provides indebted countries to reduce the nominal value of their debt but without jeopardising their economies. Deflation also means less income via sales tax and wage tax and also less consumption as companies and households save their money.

It remains to be seen how governments and central banks, especially from the West, will respond in the future to such trends. Make sure to subscribe to our newsletter, as we will be updating you on the latest developments.

Number 7: Conflict with the Financial World

Bitcoin and other cryptocurrencies offer an independent path from governments and central banks but also the banking world. The block chain technology bypasses the traditional banking world, which threatens a part of their fees, income and revenue. Banks could try to counter this by advocating for more regulation on Bitcoin and altcoins.

Number 8: Who Will be the Crypto Winner?

The first question is whether the concept of cryptocurrencies will manage to survive in its current form. The next step is to analyse which crypto will emerge as the winner and become or remain the most dominant one in the future.

At the moment Bitcoin is the most favourite cryptocurrency when ranked on volume of transaction, price, and total market capitalization. But will it be able to keep its lead and remain number one in the next decades or will there be a challenger that is better equipped to handle technological advancements.

Here is a quick introduction of other cryptocurrencies:

- Litecoin (LTC): LTC is positioning itself as the “Silver” of the cryptocurrencies whereas Gold is then considered to be the equivalent of “Gold”.

- Ether (ETH): Ether is an internal method of payment for the Ethereum platform.

- Ripples (XRP): Ripples is the payment method used for the Ripple network, which offers ultra quick transaction speed. The supply of XRP is a lot larger and a small part is released each month.

Number 9: Other Established Markets Offer Enough Trading

Some Forex, CFD, commodities and stock index traders are hesitant to trade altcoins because their instruments offer enough trading opportunities on their own. They do not want to learn a new instrument if their Forex or CFD trading is working well for them, which of course makes sense.

The currency markets offer a wide range of currency pairs that trade within established support and resistance levels. However, traders might still want to consider following cryptocurrencies as they compete for investments and attention in the global arena.

Now it’s time to mention some advantages of trading cryptos.

Advantages of Bitcoin and Crypto Trading

We mentioned 8 points that make trading Bitcoin and cryptocurrencies less attractive when compared to Forex and CFD markets. But there are some advantages too. Here is our list of pros but feel free to add your own ideas in the comment section.

Number 1: Bitcoin is Building a Track Record

Bitcoin has managed to overcome multiple hurdles in its short but lively history. The fact that Bitcoin is “alive and kicking” shows its strength to endure for almost a decade in a tough financial environment with competitors such as Gold, Silver, established currencies like the US Dollar, and other assets.

Bitcoin is being frequently used a method for payment and more vendors and stores are accepting Bitcoin. It is also clearly storing value as the market participants accept a price of more then $4000 per Bitcoin as of recently.

Number 2: Bitcoin Offers a Hedge and Diversification

Are you worried about government debt, central bank quantitative easing, and the value of fiat currencies? Bitcoin and the cryptocurrency market do offer a way to spread the risk and hedge one’s portfolio.

It should be noted that such an insurance should never be a large part of any portfolio in our view. A hedge is more a way to mitigate risk of an economic recession or even an economic downturn which is when other assets become less valuable. You can hedge with the help of markets.com, who offers one of the most robust ways of using bitcoin without the hassle of purchasing the asset directly.

Number 3: Bitcoin is Offered in Our Daily Lives

Bitcoin is becoming more accepted as a payment method and as a storage of value. Shops are offering the ability to make Bitcoin payments and there is an increase in Bitcoin services. The media is also covering Bitcoin in more detail as the price grows and the application of the currency increases.

Number 4: Cryptocurrencies Do Solve Problems

Although people from the West might not see it, the cryptocurrencies do actually solve problems for citizens of many countries. Here are some issues that could stimulate demand for cryptocurrencies:

- High inflation: when prices in the shop rise quickly, it could be a good alternative to have some of the cash stored in cryptos.

- Capital controls: some countries restrict the movement of capital from the country. Bitcoin was for example popular in Argentina, which made transfers difficult.

- Confiscation of assets: a government is able to stripe away ownership of many assets but not Bitcoin.

- Ultra high fees: bank transfer and payment fees do add up and Bitcoin seems to be challenging that cost structure.

The first 3 of these points are less problematic for Europe, Japan, and the US who for instance have not seen high levels of inflation for a while but altcoins could be a guard against inflation. These countries also have free movement of capital.

Number 5: Lots of Momentum

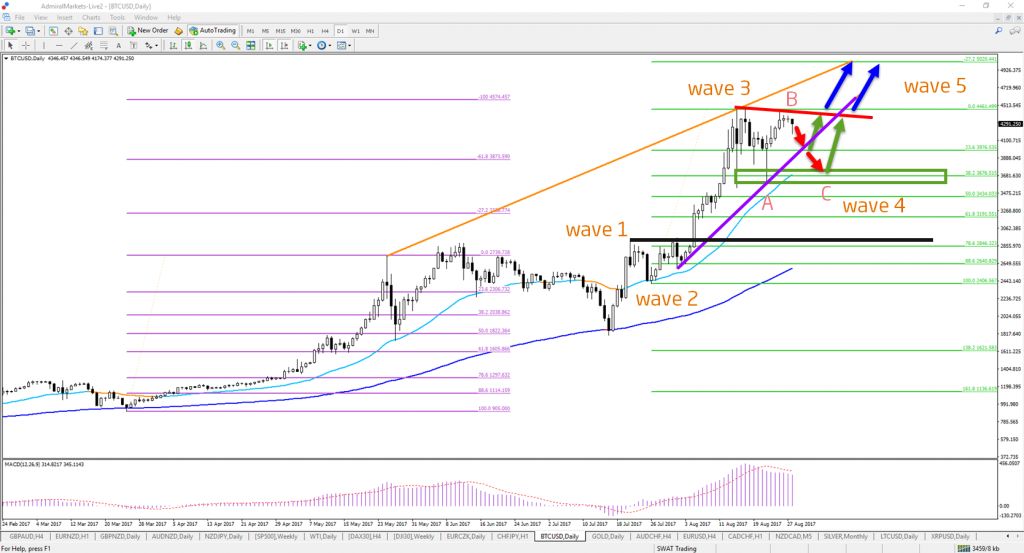

There is certainly enough price movement with cryptocurrency pairs like BTC/USD, LTC/USD, and ETH/USD. Here is an example of our chart analysis. You can catch the momentum by joining our telegram group for free. We provide signals and analysis for cryptos, fx, stocks and commodities.

Number 6: Are Big Players Stepping into Altcoins?

It is still too early to tell but could big players like banks and even countries secretly be buying cryptos and Bitcoin to hedge their assets and reduce their vulnerability on the US Dollar and Euro? It remains impossible to impossible to answer for sure but one could speculate whether this trend is occuring.

Russia, China, oil exporting nations, and maybe even Australia could perhaps be using cryptocurrencies and the mining process to reduce their reliance and dependency on the US Dollar. You can also trade cryptos, including altcoins, with one of our supported providers.

Number 7: Petrodollar, Western Debt, Economic Slowdown

Big players could be looking to reduce their exposure to the US and the EU perhaps due to the large debt that the West has gathered in recent decades. The Great Recession of 2008 pushed the budgets of the governments and the balance sheets of the central banks to the max. A new financial and/or economic crisis could be difficult to handle with budgets stretched thin.

Big exporters like China and oil exporting nations like Russia and Saudi Arabia might want to be less dependent on the US Dollar and other western currencies. They might also doubt their ability to pay back the debt via inflation and weak economic growth.

Conclusions and Solutions for Trading

It is worth trading Bitcoin?

Ultimately all traders need to take their own decision but the above mentioned points hopefully help sort out some of the pros and cons.

The answer will also depend on your risk appetite and your method of trading:

-

- We will only be using some of the time frames:

- Short-term trading: OK. In general, we ourselves are open to trading Bitcoin and cryptocurrencies in the short-term. The risk of Bitcoin and the altcoin market collapsing in next days or even weeks seems small. So holding trades for a few days or even weeks should be fine. You can use markets.com CFD on crypto offering for this.

- Medium and long-term trading: wait. Here the ability of analysts to make solid trading plans seems a bit limited. There are also other risks that could cause strong volatility like a new hard fork (another split of Bitcoin).

- Buy and hold: OK. Investing in Bitcoin and a bit in other cryptocurrencies could be ok in our view as long as it remains a small part of the overall portfolio. We are thinking of buying Bitcoin on dips but will keep the exposure limited to a small part like 1-2%.

- We will only be using some of the time frames:

Last 3 Tips for Bitcoin and Cryptos

Last but not least, keep in mind these 3 aspects:

- Have an account with either a trusted exchange (Bitstamp, Kraken or Kucoin Excahnge) or a broker, the former offers raw spreads while the later gives an opportunity to trade with leverage fo up to 1:5 and more flexibility with going short.

- Make sure to learn how to read, interpret and use charts and technical analysis if you are new to trading or technical analysis. Reading all the fundamental news in the world is impossible but it is possible to see how the marketplace really interprets and reacts to the news by following and analysing price.

The best way to learn to trade the market is via our ecs.START course (free) or via our trading courses and systems ecs.SWAT (more waves) or ecs.CAMMACD (more technical).

- Place more emphasis on trend and momentum than support and resistance. Using the triangle of analysis is the best to understand market structure and market psychology but in this case S&R (support and resistance) levels might be less valuable.

- Keep an eye on and be aware of other cryptocurrencies. Be wary of the small and medium cryptocurrencies as they still need to prove themselves. Bitcoin, Litecoin, Ripple, Ether have the a better track record and could be more accessible to trade. But of course, don’t fall asleep behind the wheel: doing analysis of smaller cryptocurrencies could be worthwhile too in case one of them starts to show potential for larger growth.

Make sure to sign up to our daily updates and analysis as we will provide our view of technical analysis on trading cryptocurrencies like Bitcoin (BTC/USD), Ethereum (ETH/USD), Litecoin (LTC/USD) and other altcoins such as Ripples (XRP/USD).

Happy trading and many green pips,

Chris Svorcik

My twitter: @ChrisSvorcik

More info on our ecs.SWAT course and trading system

Elite CurrenSea Twitter: @EliteCurrenSea

YouTube: Elite CurrenSea

Great article