cammacd.MTF Trade Journal from Tarantula FX (April 24 – May 5)

Dear Traders,

The week behind us was a bit nervous, but we managed to squeeze profits despite the generally slow and rangy market conditions.

Today’s article explains the positive cammacd.MTF performance despite the lack of price volatility and despite the presence of 3 major news events. But at the same time, I will also share my thoughts on how the body and mind connect…

10 Wins From 13 Setups

A general lack of volatility was a main factor, primarily due to the so called Golden Week in Japan, which is a series of four national holidays that take place within one week at the end of April to the beginning of May (each year). It is often considered a time of vacation for the Japanese people, and many people receive time off from their employment on these bank holidays.

A lack of volatility couldn’t stop us from scalping the market at the beginning of the week. Using the newest addition to MTF template – Breakout trading, our ecs.LIVE Telegram group managed to get nice 16 pips on the EUR/USD on May 1. The market simply couldn’t provide us with the more significant volatility as the ATR (5) on the pair was a meagre 44 pips back then.

Source: CAMMACD.MTF – Breakout

Source: CAMMACD.MTF – Breakout

Later during the week, we had only three losses out of 13 trades total. One of them was the breakout NZD/USD trade which initially went in profits but then turned against us, although the NFP result was positive for the US… Well, such is the market.

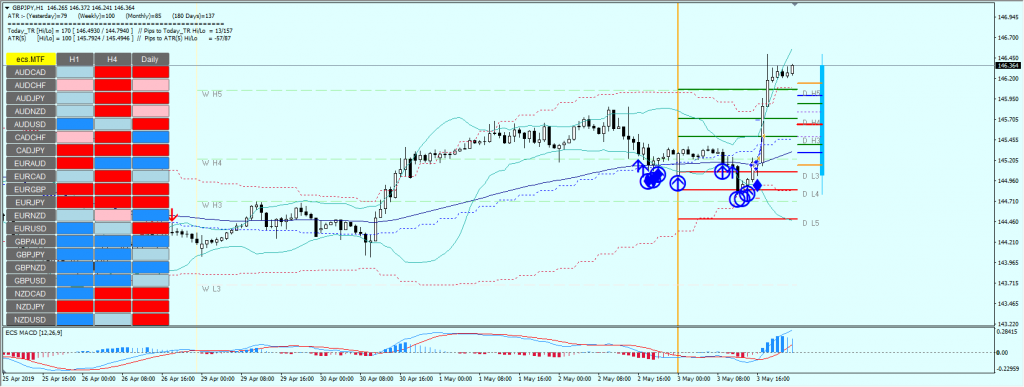

Having high confidence in my CAMMACD system as always, I managed to spot the trade of the week – GBP/JPY. We managed to grab fantastic 41 pips 2 times, totalling 82 pips for 2 trades (even more if scaling in), ending the week in profits. I say excellent 41 pips because before that the GBP/JPY had made only 79 pips of the ATR.

Source: CAMMACD.MTF

Source: CAMMACD.MTF

Body and Mind

I practise metabolic training with Kettlebells and Muay Thai. I can compare trading to my sports life: I do Muay Thai 2 times a week, Kettlebell training 2 times per week, and do circuit training with running once a week. A bit too much? The repetition and consistency make all the difference.

Some weeks are better than others, that’s something that took me the longest to adjust. With each approach you make tradeoffs. Go for a flexible strategy – possibly risk a higher drawdown, while a more rigid approach might keep you dry with a bunch of canceled pending orders for days.

By trial and error, I figured that high intensity, interval exercises work best on my body type. Healthy lifestyle has been propagated all over the media, but sometimes, things are popular exactly because they work.

With a lack of consistent physical activity – mostly sitting while trading/teaching, busy schedule and a very healthy appetite, I am not able to properly transform my energy into an appropriate mental output (focused attention and critical decision making), unless I work my ass off.

It’s addictive, but I guess, if I were to choose an addiction, it would definitely be sports. It might sound counterintuitive, but the more energy I spent training the better I feel mentally afterwards.

Unlike markets, personal health is a little bit more predictable, and relying on the methodical exercise can almost certainly help you negate the impact of a sitting job, as well as to burn enough energy to enjoy food without undermining the benefits of the regular cardio exercises (that one can help you make it longer on the market by improving your cardiovascular system and lifespan).

The bottom line – the mind always needs to connect with the body.

I’ll be taking the subjects of mental and physical health in the future entries. Will you have questions or want to add a point, I’d be happy to hear from you in the comments.

I expect the market to start moving and we should definitely see new pips during the week.

Meanwhile next week I am gonna try a new program from Kettlebell! 🙂

Sincerely,

Nenad Kerkez Tarantula aka NKT

Leave a Reply