Nenad and Chris on How They Started Trading

Dear Traders,

Chris Svorcik and Nenad Kerkez, aka Tarantula FX, have been trading and analysing the markets for more than a decade now. Some of you might know them from Forex Factory or FXStreet while others might know them from XM broker, Admiral Markets, Investing.com or Elite CurrenSea. Both Nenad and Chris have earned awards from FXStreet and they have had several live seminars as well including London, Zagreb, and Prague.

This time Nenad and Chris open up their doors with untold stories about how they started trading. They speak about how they started trading, their learning process, and what motivates them to continue.

How Nenad Started in Forex

Nenad explains his starting point. My journey as a trader was connected to the job that I had before starting a full-time career as a Forex trader. I had a job as an agent for BNP Paribas Mutual Funds where I offered their products and portfolios to potential investors.

The average return on investment (ROI) was 5-15 % per year, which was an attractive offer for many investors. It was certainly much better than just leaving the money in the bank. Then somehow during one of my meetings with potential clients, I heard about the Foreign Exchange Market and how it offered an alternative investment opportunity. I knew right there and then that Forex trading could be very lucrative so I started to ask around.

A couple of days later I was approached by a guy who dealt with some products related to Forex portfolios. The promise of 5-10 % ROI per month sounded appealing. However, I didn’t want anyone to manage my money for me, so I decided to do it myself. During the next few days, I searched the internet and found a local white label broker.

They were offering some paid education, so I decided to take a go. Well, at least it was an informational one. Of course, I was still a newbie, and I was thinking that it shouldn’t be that hard. I decided to place an initial 1k deposit. After a few winning days, I was so happy, so I decided to take more risk. After two weeks, my account was almost doubled. And then there was an NFP announcement and I decided to trade it. I remember it so clearly because I was utterly ignorant of the volatile and wild price action during the NFP. Out of the blue I lost it all in a matter of a few hours…

I said to myself: “This will never happen again”. And the rest is history…

Nenad Develops his Own Style

I opened a demo account with a 10k deposit and spent 12/7 staring at the screen, learning price action, hiding from the boss (pressing windows key) whenever he enters the office. I was so eager to learn to trade, and nothing could stop me.

I realised that Forex trading requires dedication, and I knew it from the start. But after losing my entire account on 1 afternoon, my commitment was even stronger. This iron will made me so determined to push myself to a higher level.

During the next (2nd) year, I applied all the knowledge I had to make myself profitable. But I studied more: primarily price action, opening trades at the very best moments, and implementing different strategies based on various market movements (I call it modules today).

My number one learning moment occurred when I realised that trading just one method or system was not enough due to ever-changing market conditions. So I studied pivot points, MACD, Camarilla and that was the time when I also read the book from William Blau: “Momentum, Direction, Divergence”. I studied all of that on my own, which eventually lead to the development of my CAMMACD modules and templates. Full price action.

The end result was approximately a profit of +28% by the end of the year. I was happy. A full year of profitable trading was behind me. The account was small but I treated it as if it was a 10 million account. The same psychology, calculated trades, applying just a small bit of risk to every trade I made (<5%). Of course, someone would say, that I could have made more but let’s be fully honest: +28% is not bad for a beginner.

The first two years also helped me learn one critical lesson. I managed to identify the true Holy Grail: money management. Without proper money management, no one has a chance of becoming profitable when trading the Forex market. Besides having a good method you really need to focus on even better money management.

After realising this eternal truth, I made a real deposit of 10k and started to trade live. My motto was: rigid discipline while religiously following my trading plan.

I started a thread on Forex Factory with the nickname T@rantula and soon I became one of the most popular traders out there sharing knowledge and experience with traders. Traders wanted to know more about my methods and systems which is why I – together with Chris – started our own home and hub called Elite CurrenSea (ECS).

Share our passion for trading and learn from our methods and techniques by:

- Joining our premium ecs.LIVE channel.

- Subscribing to our ECS YouTube channel with:

- New Price Action Trading School (PATS)

- Monday Weekly Setups

- EUR/USD and GBP/USD videos from Chris

- Bitcoin, Gold and Stock Indices with Chris

Now it’s time for Chris to share!

How Chris Started in Forex

Summer 1999. The world was making a global countdown to Y2K, also known as the year 2000. Younger readers might not know, but everyone was scared that the computer systems would stop functioning with the start of the year 2000, which would cause a total global chaos. This fear was based on the fact that computers were unable to handle the new 2000 format as they were written with “19xx” in mind. This is why all computers systems required updating before the turn of the century.

It was also a time of financial peaks and lows. At the time when the dotcom bubble was in full swing (collapsing in 2000), the US Dollar (USD) reached a new peak and cycle high and gold was making a new low.

I (Chris) was 19 years old at the time and already at that time I was following the US Dollar. My Dad was an International Sales Manager of heavy construction equipment and vehicles in the US and his sales figures were dependent on the strength or weakness of the US Dollar. At a young age I learned from practical experience that a strong USD is bad for sales outside of the US and a weak USD was good for sales outside of the US. To me, there was nothing theoretical about this – it was as clear as day.

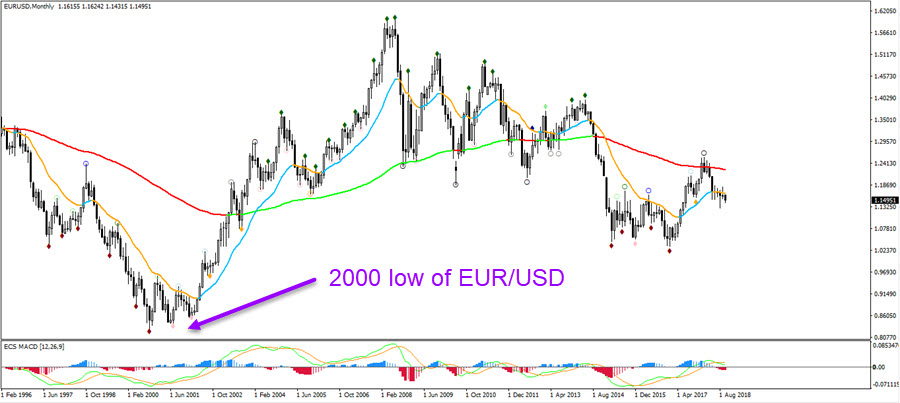

Unfortunately for my Dad, the US Dollar hit one of its all time highs versus the EUR in the year 2000 and his company decided to let him go. The timing was ironic because the EUR/USD hit a low of around 0.83 in November 2000, which till this day is still the lowest low in the last 20 years (1998-2018). After that low, price only went one direction: up, up, and up.

By 2002 price had already broken above the parity level (1.00) and a huge uptrend was about to start. In 2003, price broke above 1.10 and 1.20 and in 2004, it broke above 1.30. Between 2007 and 2008, price even managed to peak above 1.40 and make an impulsive climb all the way close to 1.60 before retracing back down again.

The USD went from super strong to super weak in a matter of a few years. My Dad was unlucky as the strong USD forced the company to take action. He had no choice but to retire earlier then planned at the age of 60. Luckily for him it ended up well as he was “only” a few years away from his pension. At a young age, I could see the immediate effect of a strong or weak Dollar first hand.

For me, currency movements were not some fancy theory that students read in a book, but they had real life consequences for my Dad, my family and myself. This made me wonder, why do currencies move as they do? Is there a way to explain and understand it? Is there a way to analyse and forecast??

Avoiding Post-Fact Ideas

My Dad would usually turn on the TV to monitor the developments of the US Dollar movement. Nowadays, we can open any trading station such as the MT4 platform and we are able to see all the price movements ourselves, thanks to the beauty of fast internet. But internet was still slow and relatively new back in 1999 so for many, the main source of information was TV and print (newspapers, magazines, books).

The financial TV shows however failed to provide me with any solid answers. They focused mostly on explaining events after the fact and did not place much emphasis on the future. How many times have you not heard an explanation on financial TV news where an explanation was provided at the end of the trading?

Most of the reasons are done afterwards. A headline could read something along the lines like “stocks move down an “x” number of points as global investors fear high inflation.” The news outlets seem to make a nice “story” but were not able to apply the same logic beforehand. All in all, fundamental analysis did not some to provide the methodology that I was looking for. It did not look like a sustainable module to me and I wondered if there wasn’t a way to analyse the charts and markets pre-fact?

This is how and when I discovered the world of technical analysis for the very first time, which immediately appealed to me because I am a fan of charts and graphs. Having the ability to draw on the charts themselves made it even more interesting. The idea that all information is incorporated into price also made and still makes a lot of sense to me. Fundamental aspects do drive price and influence it, but who can determine the impact of each aspect? Who has time to analyse all factors and weight importance to each aspect? These questions provide almost impossible to answer besides for the biggest banks in the world with a research team that includes 100s of employees and massive computer power.

Fundamentals can be used to understand how price will move in the long-term but from our experience, it proves very difficult to use for short or medium term purposes. The range of fundamental issues is very deep and wide, which makes it difficult (I would say almost impossible) to assess short-term price movements by using fundamental analysis only, at least in the world of Forex. For Cryptocurrencies many price movements seem to be driven crypto news and new updates and hence technical analysis, price patterns and indicators seem to have more weight in the world of Forex than in cryptos, at least for the next year or two.

Our Belief System: Wave and Technicals

In the world of Forex, we believe that technical and wave analysis are the most valuable methods for understanding charts and judging what might happen in the next hours and days pre-fact, not post-fact. This is especially true for the Forex market because stock trading does depend more on company fundamentals, which tend to change quicker than the fundamentals of an entire nation or currency bloc. As an intra day and intra week Forex trader, I value technical and wave analysis the most.

Ultimately my desire to understand the Forex market was developed during my formative years. It was like a part of my childhood and upbringing. It is therefore perhaps not so surprising that later on in life I became a Forex trader, analyst and educator.

The first time I seriously took a look at Forex was 2004. My entrepreneurial spirit was already visible at a young age as mentioned in the introduction after receiving a 3rd place for the best business idea (online football manager game) in 1999 at the age of 19. I also had tons of other business ideas including but not limited to multiple board game ideas, multiple fast food restaurant ideas, multiple book ideas, multiple IT platform ideas, charity ideas, and much more.

After four years, unfortunately, the online football manager idea didn’t work out (due to lack of reliable IT partners) and I decided to focus on a master’s degree instead in 2004. Forex was a hobby for me during those student years. When I graduated in 2006 and 2007 (completing two masters degrees), I already had a couple of years in trading under my belt but full-time trading seemed too risky. I joined the corporate world, but was disappointed by the lack of challenge and the restrictions due to corporate policies.

In 2010 I decided that enough was enough and made a plan to transition from a full-time employee to a self-employed and independent trader. The transition phase lasted a full year until my last office day in April 2011. That’s what I call planning. Now it’s more than 7.5 years later and the ride has been amazing.

Since 2012 I have worked with pleasure together with my friend and business partner Nenad Kerkez, who has a very inspiring personality and a very warm and open character. Together we tackle every trading challenge imaginable. In fact, we formed such a good team that we decided to start our own EliteCurrenSea.com website together in 2014. In the meantime, we have taught thousands of Forex traders how to tackle Forex trading.

Join our World of Trading by starting with ecsLIVE!

Good trading,

Nenad Kerkez, Chris Svorcik

and Elite CurrenSea

P.S. Share our passion for trading and learn from our methods and techniques by:

- Joining our premium ecs.LIVE channel.

- Subscribing to our ECS YouTube channel with:

- New Price Action Trading School (PATS)

- Monday Weekly Setups

- EUR/USD and GBP/USD videos from Chris

- Bitcoin, Gold and Stock Indices with Chris

Leave a Reply