Bank of America Survey on When We Will See the “Big Low”

Bank of America has released its latest Global Fund Manager Survey, which reveals the thoughts of 300 investment professionals about the economy and markets.

With 59 charts, it’s a mammoth document, but here are the key takeaways in our view and what they mean for your investments.

Fund Managers on the Economy

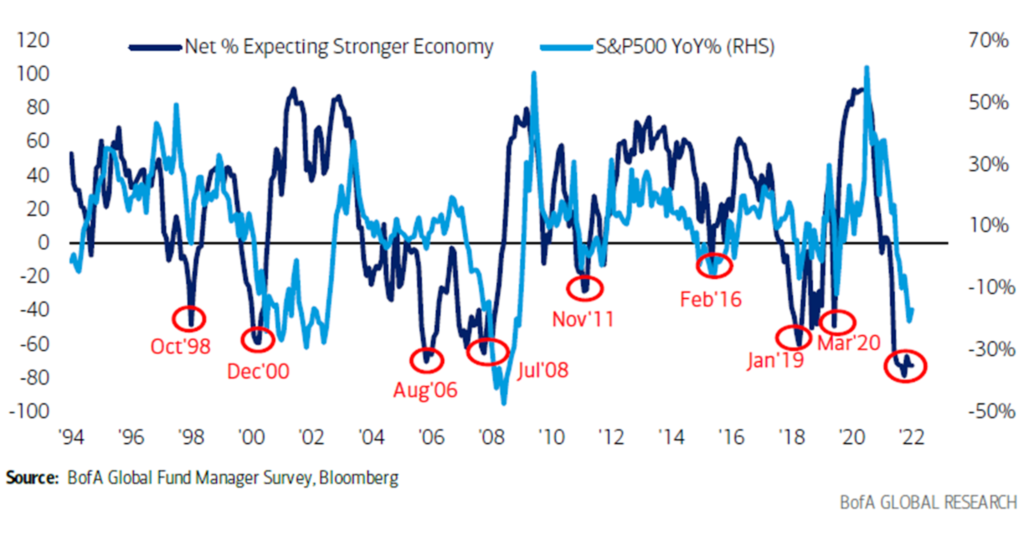

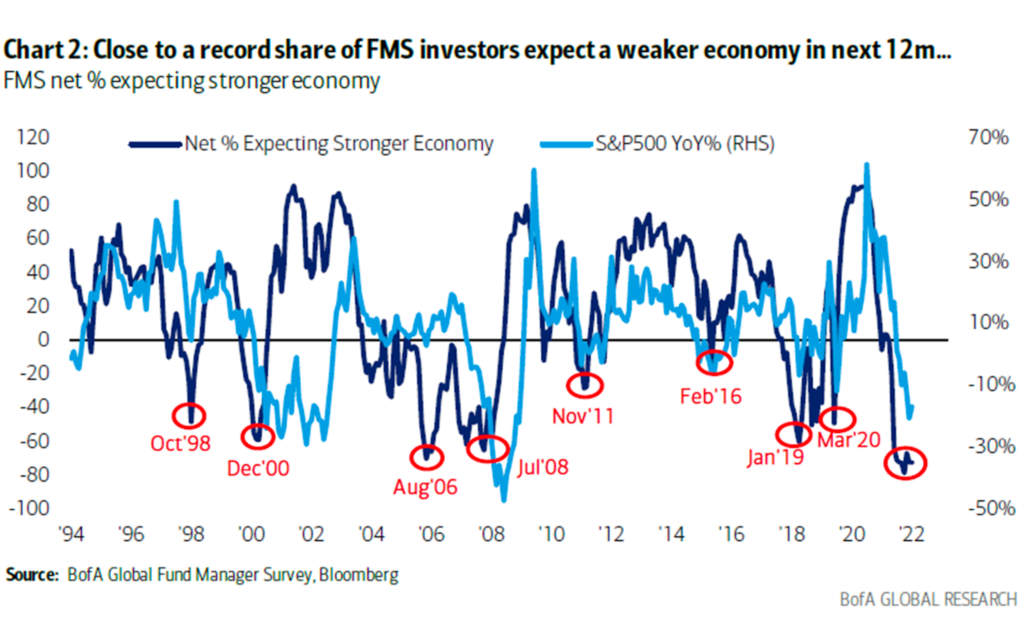

Here’s the not-so-great news: fund managers are pretty darn pessimistic about economic growth, with 72% of them thinking it’ll be weaker a year from now. The good news is that this type of max bearishness often happens before major stock market rallies. So, after some of those red circles of peak economic dread, US stocks have had good stretches ahead.

It makes sense that we’d see something similar happen this time around; investors had often seen the best returns in stocks when they bought in during times of peak economic fear.

Additionally, the BofA survey suggests that global inflation – which was 9.8% in September – is finally topping out, with 79% of the respondents expecting that number to come down over the next 12 months.

As inflation and economic growth wind down, what does the future hold?

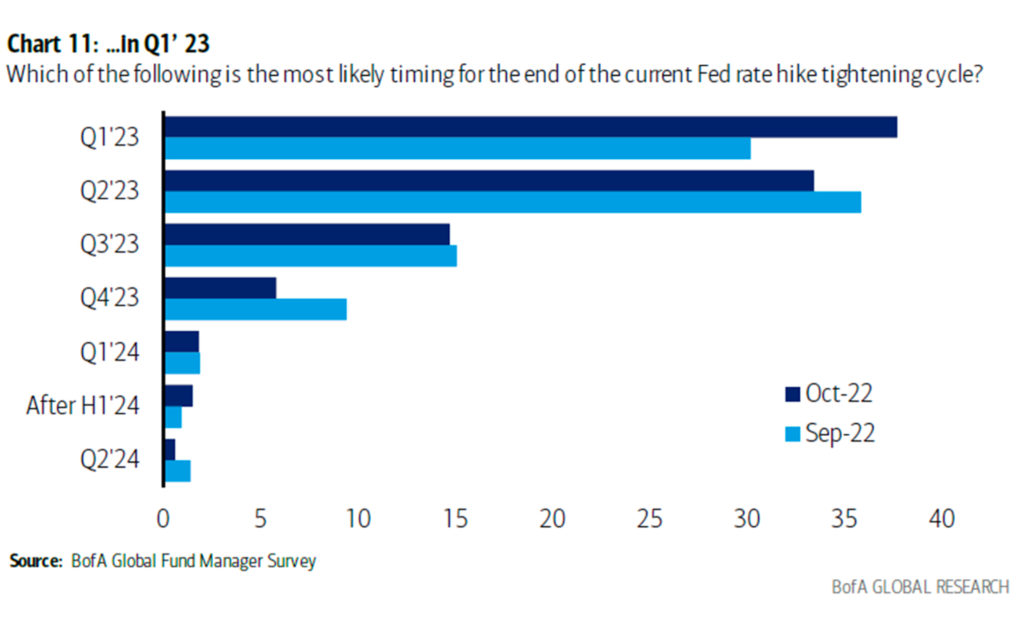

The Fed may soon stop raising interest rates, or even lower them. This would be a big change from the aggressive pace of rate hikes we’ve seen this year, which was meant to slow down spending and tame inflation. 38% of fund managers think the Fed will end its rate hikes in the first quarter of 2023.

The central bank’s benchmark interest rate is expected to peak at between 4.5% and 5% before policy makers finally take their foot off the gas, up from the current 3% to 3.25%.

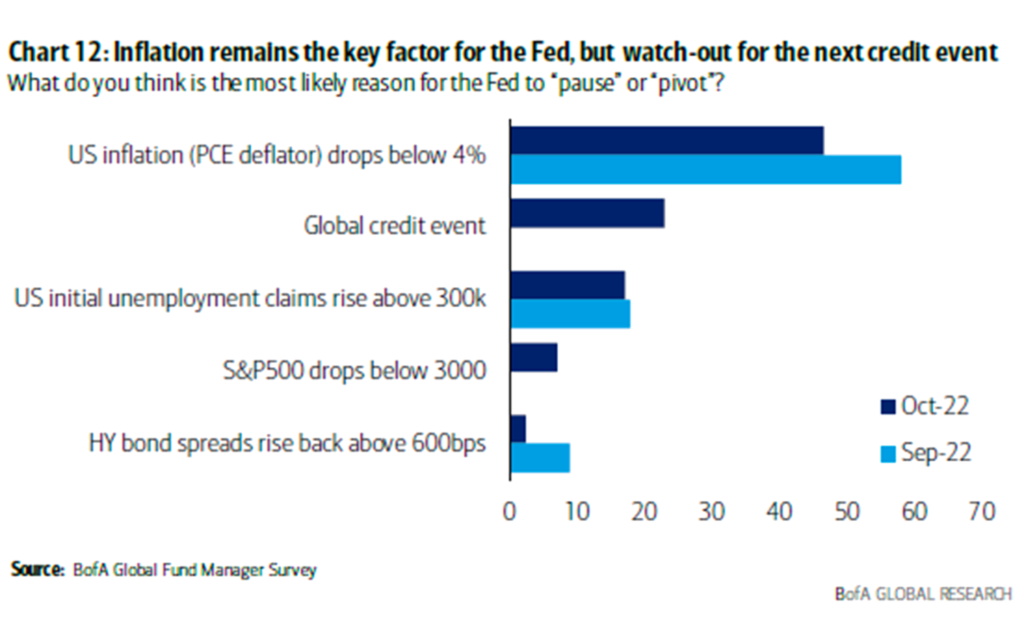

Approximately half of the fund managers think that the Federal Reserve will either pause or reduce interest rates because inflation, as determined by the personal consumption expenditures (PCE) index, will dip below 4%. Click To TweetThe other half believes that the Fed might have to shift its course due to something more severe happening, for instance, a global credit crisis or a large increase in US unemployment.

How to Play Speculate on These Predictions?

According to the survey, several “investor capitulation” boxes have now been checked, suggesting a “big low” in equities is close.

For example, fund managers are now holding more money in cash (6.3%) than at any point since 2001, and about half of them are holding less in stocks than usual. These are both signs of max bearishness – the kind of stuff you usually find at the bottom of a market… Click To Tweet

Even though things seem bad, they could be worse. For example, even though investors have been pulling their money out of the stock market, they have still been sending money to fund managers.

If they were really panicked, they would be taking their money out of those funds. That would show capitulation – where investors give up en masse, basically throwing in the towel at the worst possible time. Since that hasn’t happened, the survey suggests there’s probably one last washout ahead – before a rally in early 2023.

Even if there is one last stock market crash before the next big rally, smart investors can still profit by buying into stocks (going long) that are undervalued. And according to fund managers, the most promising stocks can be found in Japan, followed by emerging markets, the United States, Europe, and the United Kingdom. So if you’re looking to make a quick profit, it might pay to go with the consensus and pick up some Japanese stocks. A good option is also to short some for shorter-term gains.

Just as always, for Pete’s sake, keep a reasonable margin on your accounts to catch both shorts, as well as have enough equity to not be kicked out of longer-term bets should the markets tank lower on their eventual way up.

Take a look at what UK stocks (as well as index short and long mix), we believe should look good as your next moves.

Aside from geography, more than half of managers think stocks with quality earnings and good dividend yields will do better in this environment, these are usually your banks, energy companies, etc.

Overall, the fund managers believe, the markets offer exciting new opportunities for as long as the world doesn’t collapse. We have to agree with this unoriginal, albeit somewhat prudent approach to speculating on the current situation.

In other words, buckle up and stay strong by not trading more than you can afford to lose should you need extra cash in the wake of the global financial crisis.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply