Trading Ideas: The Asian FX Conundrum and Potential Opportunities

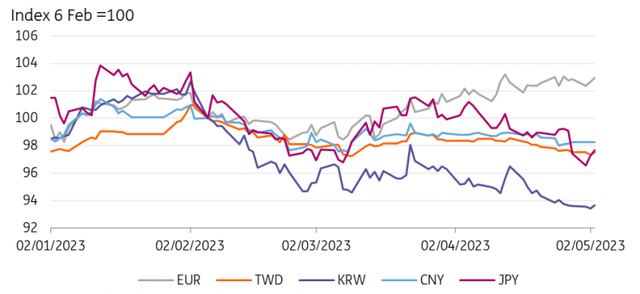

Asian exchange rates have, since February, been following a different rhythm than the EUR/USD correlation observed last year. This intriguing development prompts a deeper analysis of the economic implications and the duration of this divergence.

Traditionally, a firm grasp of the EUR/USD direction simplifies predictions for individual Asian currency pairs against the USD. Yet, this year has seen Asian currencies showcasing their individuality, often contradicting the dominant EUR/USD trend, which has led to an irregular weakening of the USD.

Identifying the root cause of this trend could provide valuable insights into whether Asian FX will continue on this unique path or fall back in line with the overarching FX theme of USD weakness.

The Mystery of North Asian FX Behavior

This trend appears predominantly in North Asian currencies. Most of these currencies are today no stronger, and often slightly weaker, against the USD than they were in February, which contrasts sharply with the Indonesian rupiah’s superior performance over the euro during the same period.

The divergence seemed to have begun in early February, with the high-beta Korean won acting as the regional benchmark. Yet, the real departure for North Asia’s major currencies from the euro occurred between 23rd February and 3rd March. This period precedes the closure of the Silicon Valley Bank on 10th March, leading to speculation about the role of US banking problems in this shift.

Potential Factors at Play

Aside from economic concerns, geopolitical factors may also be influencing the Asian FX market. The US’s significant arms deal with Taiwan and China’s underwhelming stimulus pledges during the Two Sessions meeting in early March were major geopolitical events. Additionally, the struggling global semiconductor industry, which is crucial to North Asia, could also be impacting these currencies.

Looking Forward: Trade Suggestions

Given the complexity of these factors, it’s challenging to pinpoint a single cause for the divergence of North Asian currencies from their Southern counterparts or benchmarks like EUR/USD. Yet, this complexity also opens up potential trading opportunities.

- JPY Trading: The Bank of Japan’s rates policy may prove to be a game-changer, especially considering Japan’s extensive US Treasury holdings and the prospects for some end-of-year Fed easing. We don’t expect the BoJ to lift its negative rates policy until 2024, but as we approach that year, speculation may boost the yen.

- KRW Trading: The KRW, strongly influenced by JPY, could also see changes as speculation about the BoJ’s policy grows.

- Sector-specific trading: With an expected upturn in the semiconductor cycle in the second half of 2023, currencies closely tied to this industry, such as the Taiwan dollar and Korean won, might present attractive opportunities.

These trades, however, come with a caveat. While North Asian FX could see improvement over the second half of the year, the rebound is likely to be modest given the complex interplay of factors influencing these currencies.

Safe Trading

Team of Elite CurrenSea

Leave a Reply