ecs.SWAT Catches +84 Pips on EUR/USD and NZD/USD Trade Setups

Hi Trader,

Yesterday I shared my vision and outlook on the Forex market using the ecs.SWAT method. In this analsyis I explained my clear preference for trading the US Dollar weakness trend.

Yesterday’s video analysis showed why long setups on the EUR/USD and NZD/USD were the best currency pairs.

This new article quickly explains how I traded both setups for a total of +84 pips. It also indicates how I managed to catch both setups by using the ecs.SWAT methodology.

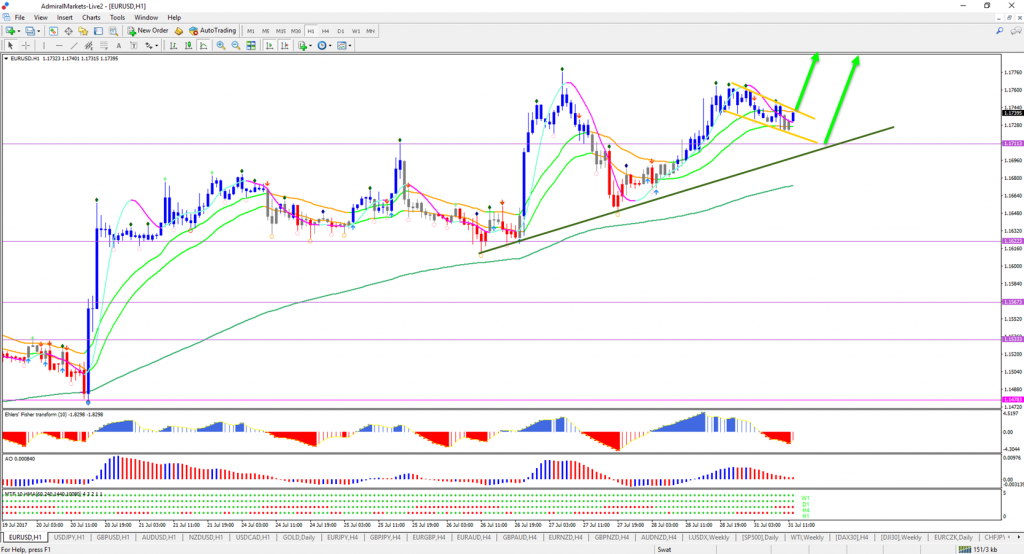

EUR/USD Long Closes for +84 Pips

As discussed yesterday, the EUR/USD broke above the 4th Wizz level and was ready for a continuation towards the 5th level. The Wizz tool is the best for finding the Wide Open Spaces and is especially valuable when breaking above the 3rd and 4th levels. In these cases, traders should prepare themselves for big movementum price movements.

Besides the Wizz tool, price was also building other key chart patterns such as small bull flag. This indicates a pause within the larger uptrend and the potential for trend continuation when the pattern breaks.

Therefore, the trigger for entry was the breakout above the bull flag chart pattern, but trading breakouts is not an easy task. Ecs.SWAT helps simplify the entries by offering clear entry arrows and candles. Simplicity at its best!

The good news is that all traders can achieve the same, by using ecs.SWAT. You can see the the trade setup BEFORE and AFTER the fact in the screenshots at the bottom.

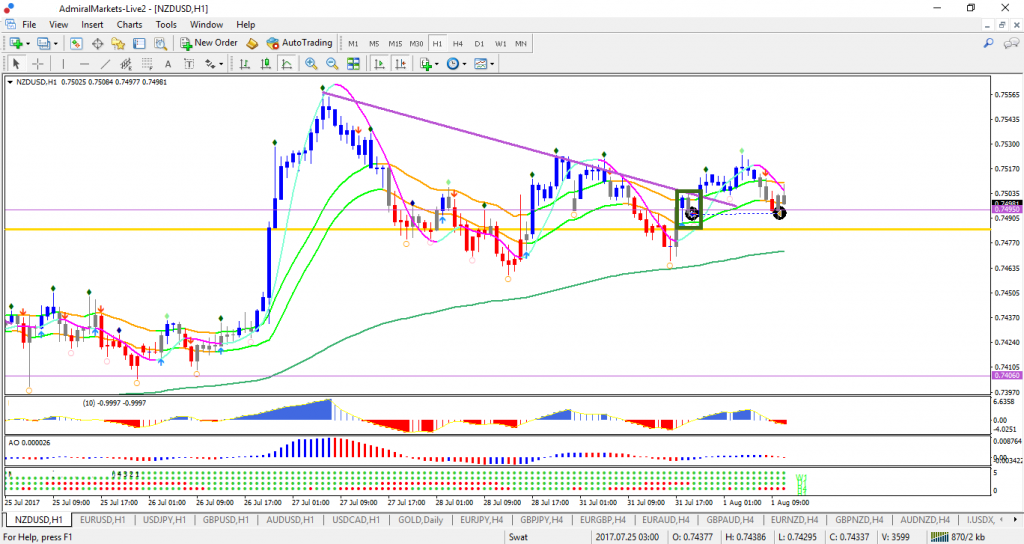

NZD/USD Long Closes for Breakeven

The NZD/USD setup closed for break even, which is fine as nothing was lost. The currency pair was in a clear bullish trend as well but the breakout was unfortunately not convincing.

The bullish momentum was not sufficient to push / break above the moving averages, which cause a new larger retracement on this pair. Luckily, my trade management plan worked out perfectly fine. Due to the trail stop of 10 pips below each Fractal support, I exited the trade at no loss (0 pips).

Many green pips,

Chris

More info on our ecs.SWAT course and trading system

Twitter: @EliteCurrenSea

YouTube: Elite CurrenSea

BEFORE:

AFTER:

Leave a Reply