〽️ DAX 30 Confirms Downtrend and Bearish ABC Zigzag 〽️

Hi traders,

the German DAX 30 index is showing bearish pressure after breaking below the support trend line (dotted blue). The bearish breakout could indicate the end of a bullish price swing and also the end of a large wave A (purple).

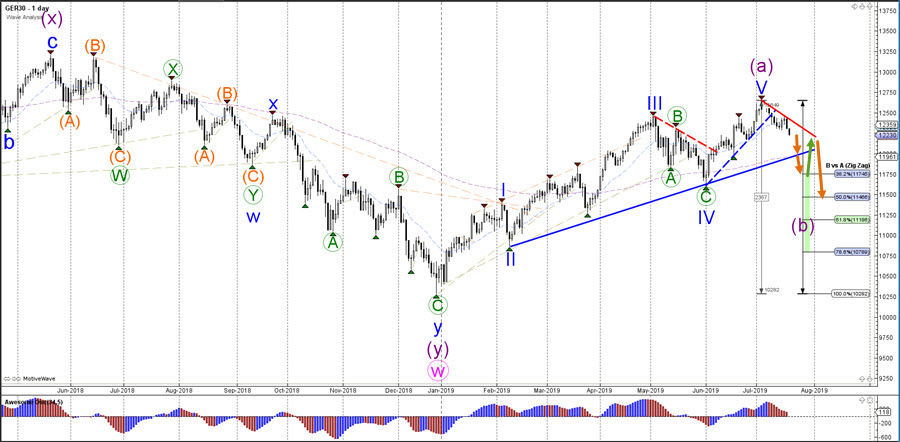

DAX 30

Daily

The DAX 30 seems to have completed 5 bullish waves (blue) which could indicate that the index is now ready for a bearish ABC correction. The bearish correction could be part of a wave B (purple) after price seems to have completed a bullish wave A (purple). A key support trend line (blue) of the uptrend channel is still a key factor for the long-term direction of the DAX and whether the price will remain in an uptrend or make a larger bearish correction (as this wave outlook expects).

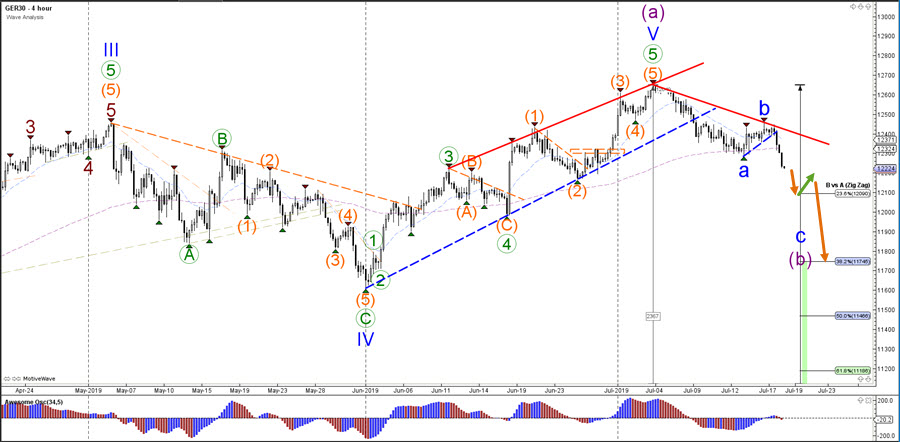

4 hour

The DAX 30 broke below the smaller support trend line (dotted blue) which is confirming a new downtrend with lower lows and lower highs. This seems to confirm the expected ABC (blue) correction from the daily chart. The next target is the 23.6% Fibonacci retracement level of wave B vs A but the price could fall lower if the bearish momentum is strong enough.

For more daily wave analysis and updates, sign-up up to our ecs.LIVE channel.

Good trading,

Chris Svorcik

Elite CurrenSea

Leave a Reply