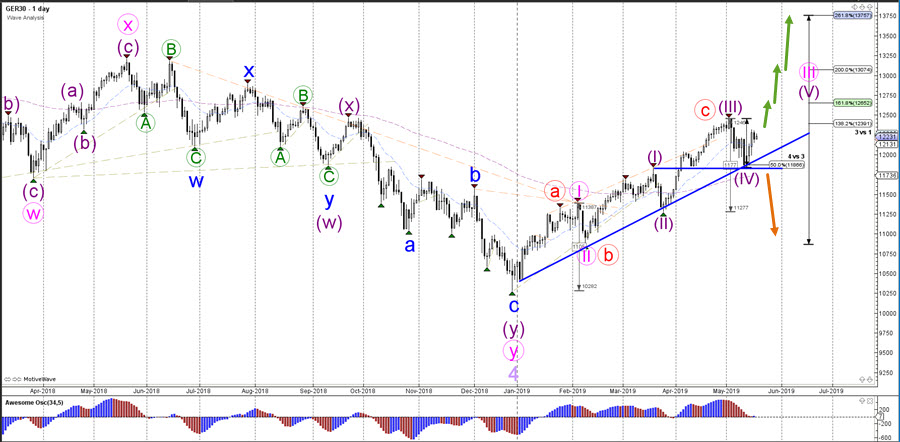

? DAX30 Uptrend if Price Respects Wave-4 Fibs ?

Hi traders,

the German DAX 30 index managed to bounce at the key support support level (blue) and 50% Fibonacci retracement level of wave 4 vs 3, which is keeping the uptrend alive.

For more daily updates check out ecs.LIVE service with live webinars, live trade setups, and live analysis.

DAX 30

Daily

The DAX 30 is now approaching the previous top, which is a critical resistance zone. A bullish breakout would confirm the expected wave 5 (purple) of wave 3 (pink) pattern whereas a bearish push below the 50% Fib invalidates it and indicates a reversal.

4 hour

The DAX 30 broke above the smaller resistance trend line (dotted red) as well and therefore seems to be building a wave 3 (blue) on a smaller time frame. The important level to keep an eye on is the 50% Fibonacci retracement level of wave 4 vs 3 (blue) because a bearish break invalidates the wave wave pattern and could be an early reversal signal. A bullish break above the top of current wave 3 (blue) confirms the uptrend potential towards the Fibonacci target levels of wave 3 vs 1.

For more daily wave analysis and updates, sign-up up to our ecs.LIVE channel.

Good trading,

Chris Svorcik

Elite CurrenSea

Leave a Reply