GBP/AUD ? Bearish Outlook Persists Below 1.7720 ?

Dear Traders,

Our previous GBP/AUD analysis has played out the bullish bounce as expected.

But the pair could very well be turning south again now.

This analysis will update our short-term forecast for the GBP/AUD.

Bullish Correction Appears Complete…

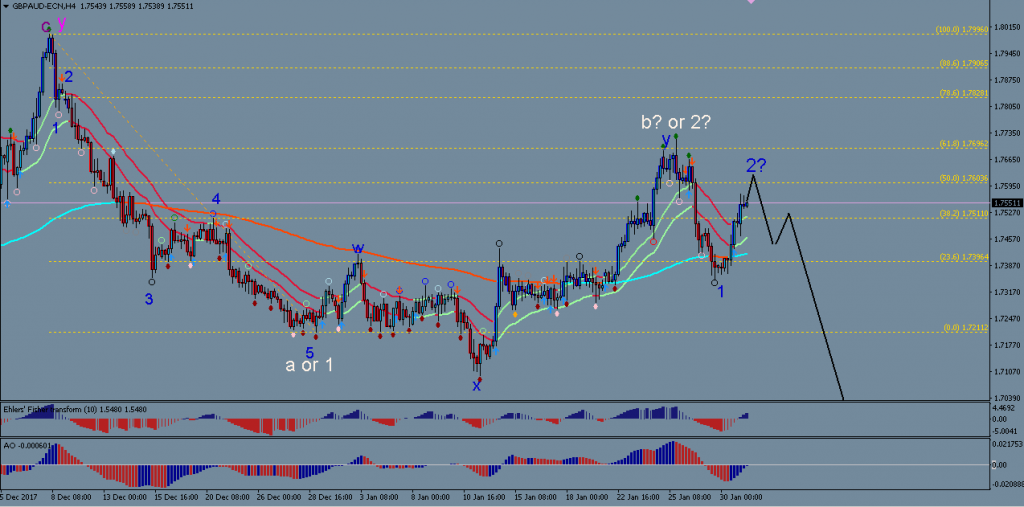

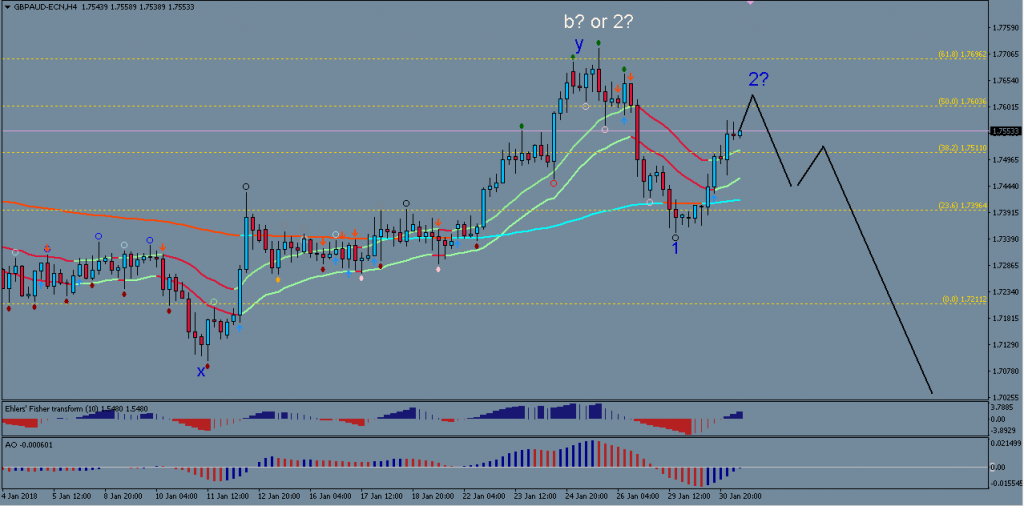

The GBP/AUD may have completed a large correction and could now be setting itself up for more downside. The zoomed out 4-hour chart (above) shows a fairly clear wave count. We expect further bearish pressure for this currency pair as the most likely scenario. Here is why:

- The corrective nature of the price-action since early January, strongly suggests that all of the bullish price movement is only a correction, potentially forming a wave b or 2. If this is true, we should see strong bearish momentum picking up soon.

- The high of 25th Jan (1.7718) could be the end of the upwards correction because a complete wave structure has formed, and price made a very impulsive bearish bounce at that level (61.8% Fib)

- The price prediction shown by the black lines is valid as long as price remains below the high of last week (1.7718) and begins to show bearish momentum while creating lower highs. This could take the pair as low as 1.65 where a long-term channel support lies.

- The alternative scenario could be that an extended correction will set in, if no bearish impulsiveness is able to form.

Trade Setups

- A good sell opportunity could arise if price can create 2 lower highs relative to the high of last week (1.7718), while at the same time establishing itself below the 21 and 144 EMAs. Short positions could then be entered and potential targets are 1.72, 1.70, 1.67 and 1.65.

All the best along your trading journey

Hubert

.

Leave a Reply