? DAX 30 Bearish Momentum Reaches 23.6% Fibonacci at 11,000 ?

Hi traders,

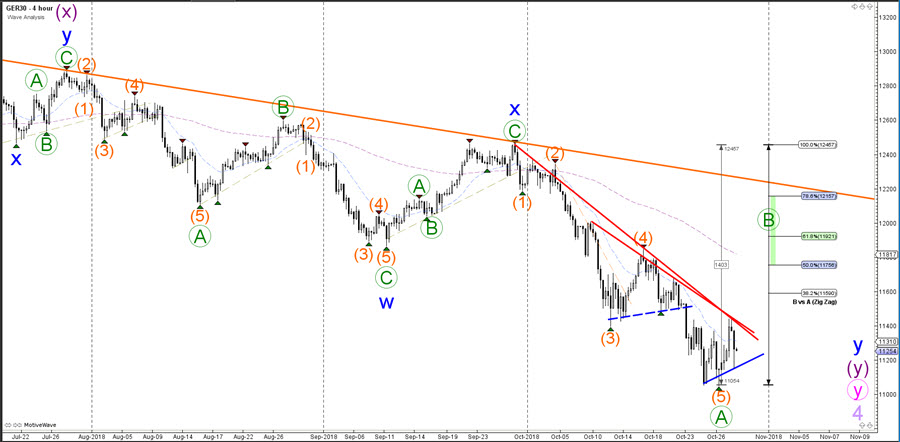

The German stock index DAX 30 is showing strong bearish momentum, which seems unfinished. Price is expected to move lower either immediately if breaking below the support trend line (blue) for an extended wave 5 (orange) or after completing the wave B (green) correction.

DAX 30

4 hour

The DAX 30 is expected to turn at the Fibonacci retracement levels if price is indeed building a bearish ABC (green) zigzag pattern within the larger waves Y correction. For the moment the trend lines however play a more important role. Price needs to break below support (blue) or above resistance (red) before the immediate direction becomes more likely.

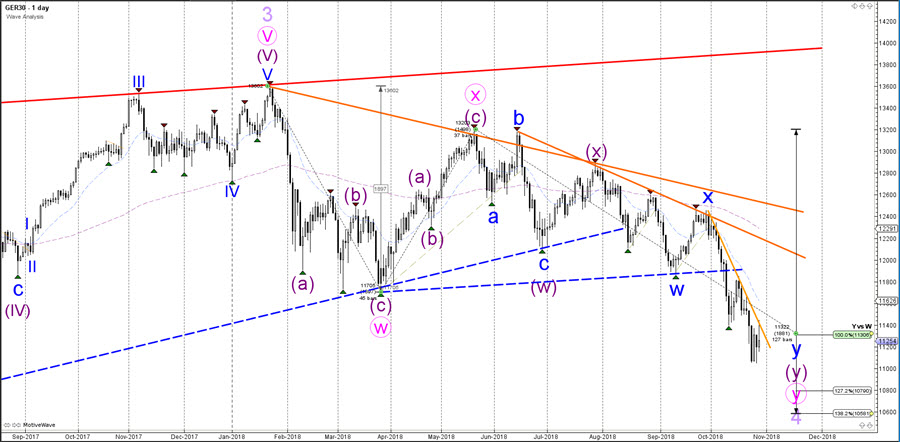

Daily

The DAX 30 seems to be building a larger WXY (pink) correction within a wave 4 (purple).

Weekly

The DAX 30 has reached a 23.6% Fibonacci retracement level of wave 4 vs 3, which is a bounce or break spot. A bearish break could see price extend down to the 38.2% Fibonacci retracement level.

For more daily wave analysis and updates, sign-up up to our ecs.LIVE channel.

Good trading,

Chris Svorcik

Elite CurrenSea

Leave a Reply